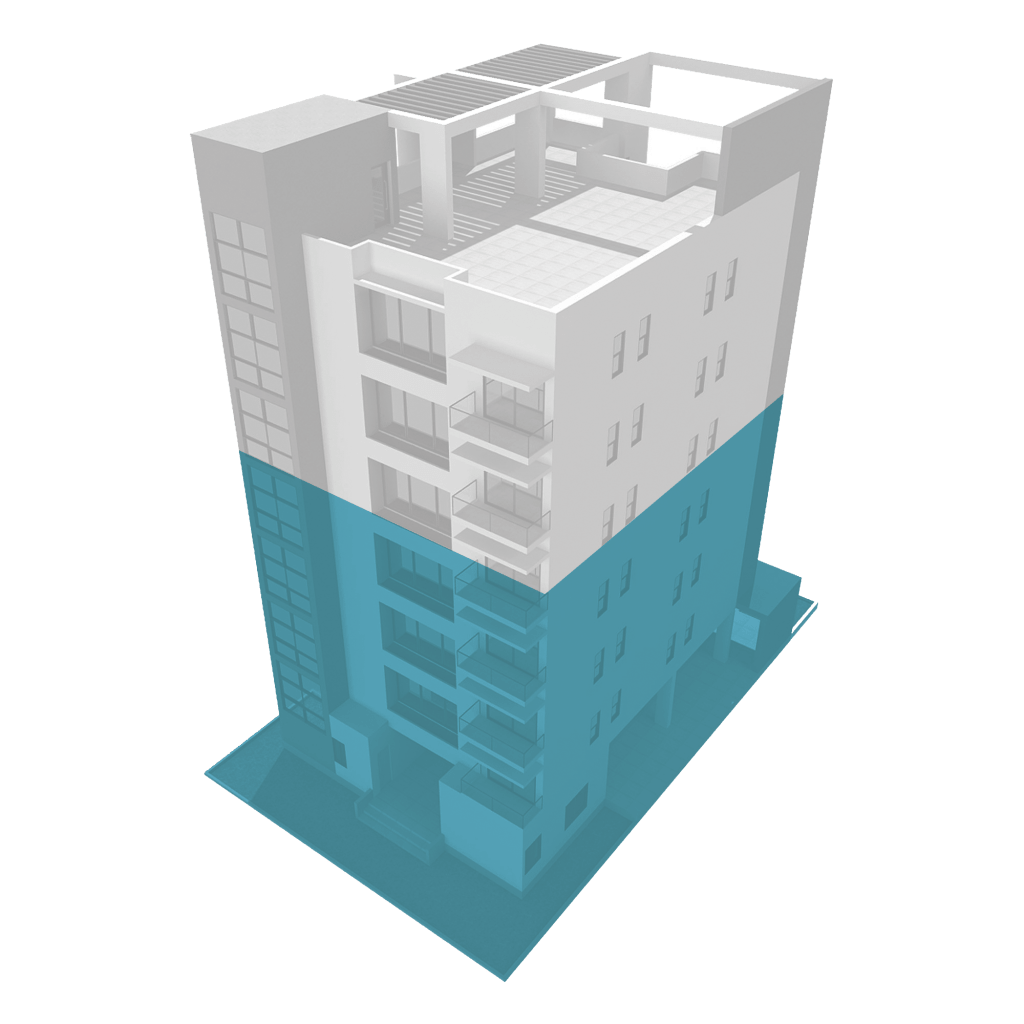

First Mortgage

Dorado provides registered first mortgage funding where there are attributes to the loan that may prohibit it conforming with covenants required by traditional banks.

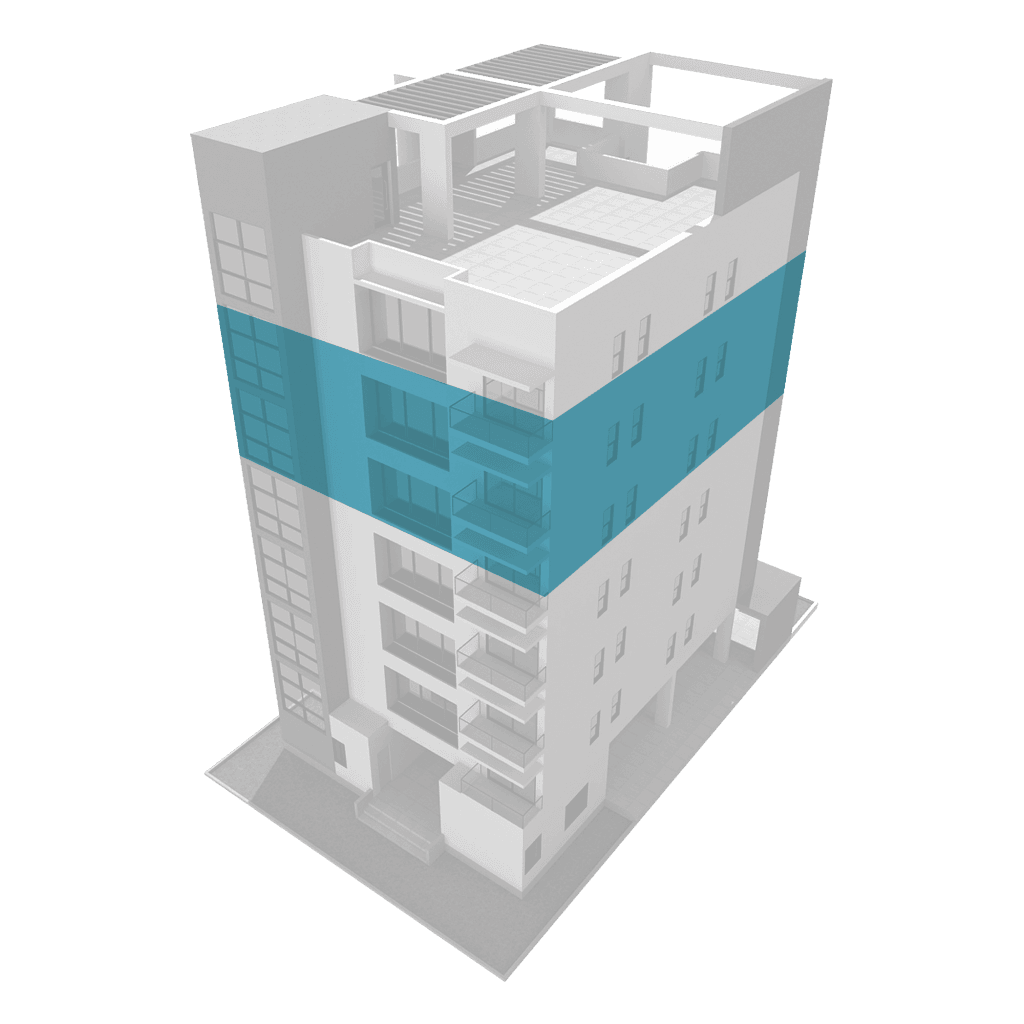

Mezzanine Debt & Preference Equity

Mezzanine debt ranks behind the senior bank and is subordinated to the bank’s position. The facility incurs an interest cost, usually not linked to the profitability of the project, though if structured as a participating mortgage it has both an interest and profit-share component.

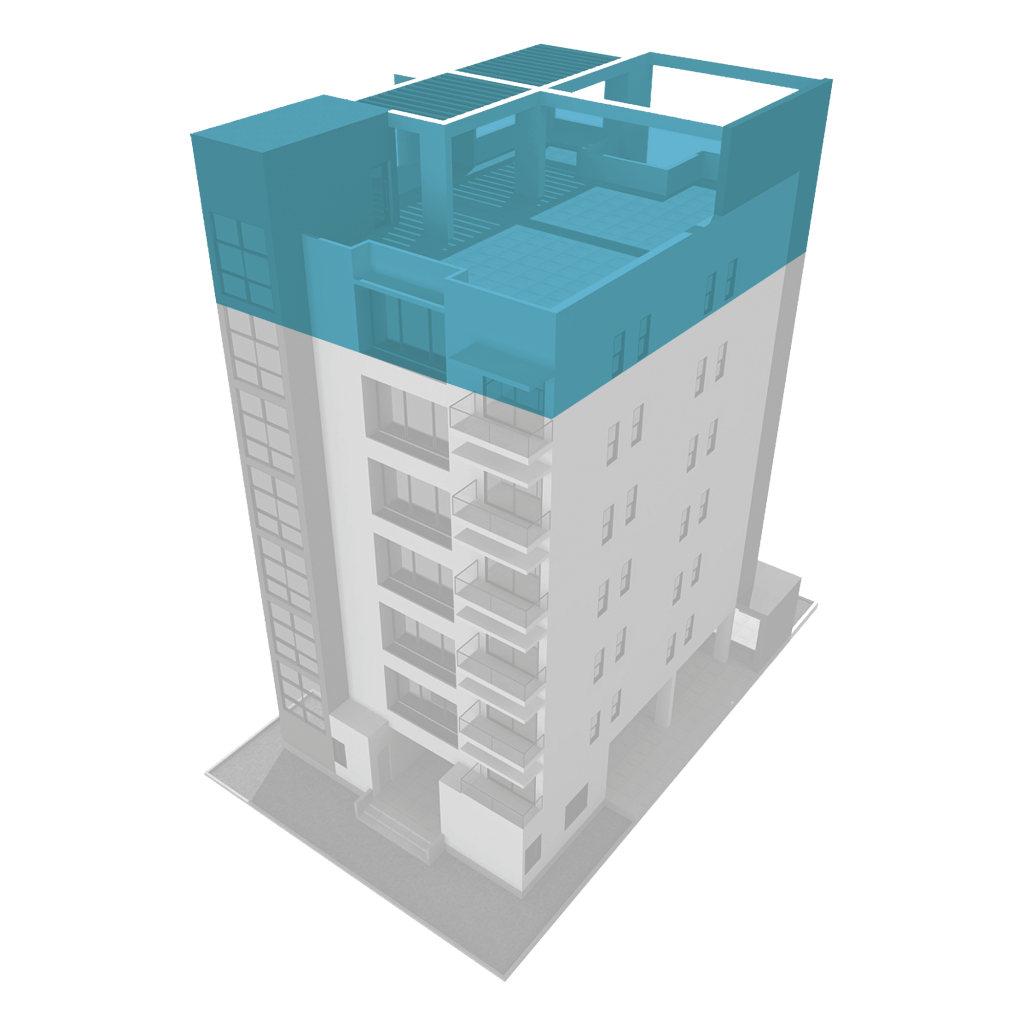

Equity

Sitting at the top of the capital stack, equity is repaid in line with all other ordinary equity after the repayment of any structured finance and first mortgage.